Market Overview

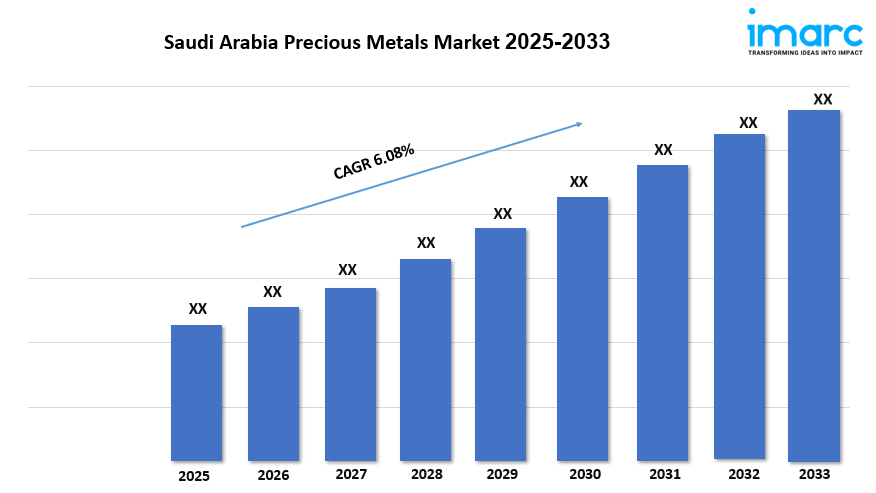

The Saudi Arabia Precious Metals Market was valued at USD 7.16 Billion in 2024 and is expected to reach USD 12.51 Billion by 2033, growing at a CAGR of 6.08% during the forecast period from 2025 to 2033. Market growth is driven by rising industrial demand in sectors such as electronics, automotive, and healthcare, alongside increased investment in gold and silver as safe-haven assets. Inflation concerns and geopolitical tensions also augment demand for these precious metals as stores of value.

How AI is Reshaping the Future of Saudi Arabia Precious Metals Market:

- AI integration in mining and refining enhances precision and efficiency, reducing costs and limiting environmental impacts while increasing precious metal output as noted in Saudi Arabia’s technological advancements.

- Advanced AI-driven metallurgical processes support production of higher-quality precious metals, appealing more to international investors.

- AI-based digital platforms facilitate easier access to metal trading and investment products, expanding market reach for both retail and institutional investors.

- Government initiatives under Vision 2030 leverage AI for operational risk analysis, regulatory compliance, and promoting private sector participation in mining and precious metal trading.

- Real-time AI analytics enhance pricing and procurement services, enabling competitive benchmarking and raw material cost analysis amid market volatility.

- AI-powered consumer insights allow customization of jewelry offerings, aligning with growing preferences for ethically sourced and personalized luxury items.

Grab a sample PDF of this report: https://www.imarcgroup.com/saudi-arabia-precious-metals-market/requestsample

Market Growth Factors

The Saudi Arabia precious metals market is strongly propelled by cultural and economic factors, especially the cultural reverence for gold as a symbol of wealth and social status, which sustains demand across jewelry, investment, and gifting segments. Saudi Arabia’s growing wealth, driven by its oil sector and economic diversification, has raised disposable income levels, enabling increased investment in precious metals as inflation hedges. The central bank reserves grew by 2.8% to SR1.69 Trillion (USD 450.31 Billion), supported by significant Aramco dividends, further stabilizing investment.

Technological improvements in mining and refining are critical to market growth, with substantial investments in upgrading mining facilities, incorporating automation, artificial intelligence, and advanced metallurgical processes. These advances enable more efficient extraction and high-quality metal production, attracting global investors. The establishment of local refineries via projects like the platinum group metals smelter under Vision 2030 reflects governmental strategies to reduce import dependence and promote value addition within Saudi Arabia.

Government policies under Vision 2030 foster economic diversification by encouraging private investments in mining, refining, and trading of precious metals through incentives such as tax relief and simplified regulations. These initiatives, coupled with infrastructure development and strengthened investment frameworks, create an attractive landscape for both domestic and international operators, further accelerating market expansion and supporting the kingdom’s ambition to become a global precious metals hub.

The Saudi Arabia precious metals market forecast offers insights into future opportunities and challenges, drawing on historical data and predictive modeling.

Market Segmentation

Analysis by Metal Type:

- Gold

- Jewelry

- Investment

- Technology

- Others

- Platinum

- Auto-catalyst

- Jewelry

- Chemical

- Petroleum

- Medical

- Others

- Silver

- Industrial Application

- Jewelry

- Coins and Bars

- Silverware

- Others

- Palladium

- Auto-catalyst

- Electrical

- Dental

- Chemical

- Jewelry

- Others

- Others

Analysis by Application:

- Jewelry

- Investment

- Electricals

- Automotive

- Chemicals

- Others

Regions Covered:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Key Players

- Saipem

- Aramco

- Platinum Group Metals Ltd.

- Ajlan & Bros

- Sotheby’s

- Vedanta Copper

- Bagatyan Gold and Jewelry

- Azza Fahmy

- PDPAOLA

- Manara Minerals Investment Company

Recent Developement & News

- September 2025: Indian jeweller Senco Gold & Diamonds is pursuing partnerships in Saudi Arabia’s USD 8.3 billion luxury sector, targeting Gulf expansion and 20% domestic growth. The company showcased at the Saudi Arabia Jewellery Exhibition (SAJEX) with over 200 Indian exhibitors, reflecting the market’s growing prominence.

- July 2025: The Gem & Jewellery Export Promotion Council (GJEPC) announced SAJEX 2025, the Kingdom’s inaugural B2B gem and jewellery exhibition, to be held at Jeddah Superdome, aiming to diversify export markets and strengthen trade relationships.

- January 2025: Manara Minerals Investment Company acquired a 10-20% stake in Pakistan’s Reko Diq mine for USD 500 Million to USD 1 Billion, reinforcing international partnerships to secure precious metal resources.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302