Market Overview:

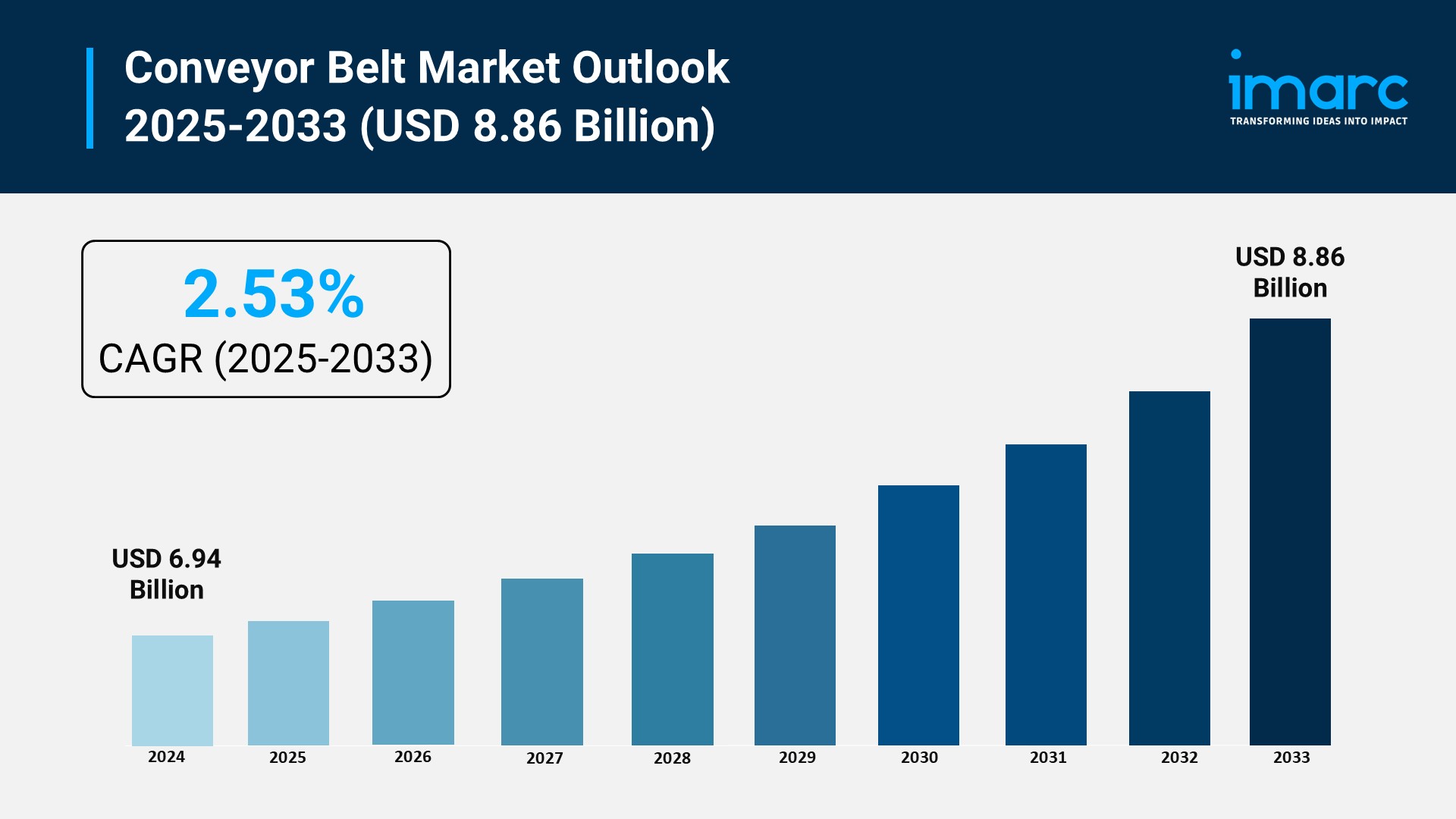

According to IMARC Group’s latest research publication, “Conveyor Belt Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033“, The global conveyor belt market size was valued at USD 6.94 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 8.86 Billion by 2033, exhibiting a CAGR of 2.53% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

How AI is Reshaping the Future of Conveyor Belt Market

- AI-powered predictive maintenance analyzes vibration, temperature, and wear sensor data in real time, forecasting conveyor belt failures with 95% accuracy, reducing unplanned downtime by up to 45% and extending belt lifespan by 30% through proactive part replacements in manufacturing and mining operations.

- Artificial intelligence optimizes belt speed and load distribution using machine learning algorithms that process throughput data, energy consumption, and material flow patterns, improving operational efficiency by 25%, minimizing energy waste, and preventing overloads in high-volume distribution centers.

- AI-driven computer vision systems inspect conveyor belts for defects like tears, misalignment, or contamination via high-resolution cameras and deep learning models, detecting anomalies 40% faster than human inspectors and enabling automated quality control in food processing and packaging industries.

- Machine learning enhances sorting and routing on multi-lane conveyor systems by analyzing product dimensions, weight, and destination codes, achieving 99% accuracy in diversion decisions, reducing misrouting errors by 50%, and accelerating throughput in e-commerce fulfillment warehouses.

- AI-integrated IoT platforms enable smart conveyor networks that self-adjust tension, alignment, and lubrication based on environmental factors and usage patterns, cutting maintenance costs by 35% and ensuring seamless integration with automated guided vehicles (AGVs) for fully autonomous material handling.

Download a sample PDF of this report: https://www.imarcgroup.com/conveyor-belt-market/requestsample

Key Trends in the Conveyor Belt Market

- Industrial Automation Surge: The integration of AI, IoT, and predictive maintenance technologies dominates the market, with smart conveyor systems projected to reduce unplanned downtime by up to 30% according to Deloitte’s 2024 Future of Manufacturing report. Continental’s expansion of its conveyor belt facility in Ponta Grossa, Brazil, in May 2025, exemplifies investments in automated production lines for enhanced efficiency in mining and manufacturing sectors.

- E-Commerce and Logistics Expansion: Global e-commerce growth drives demand for modular and high-speed conveyor belts in warehouses, with the sector expected to contribute 25% of total market demand by 2030. In the U.S., e-commerce sales reached USD 871 billion in 2021, fueling a 15% rise in lightweight conveyor belt adoption for automated sorting and packaging, as seen in Amazon’s fulfillment center upgrades.

- Sustainable Material Innovations: Eco-friendly belts made from recycled polymers and bio-based materials capture 20% market share, aligning with global sustainability mandates. Yokohama Rubber’s launch of a recycled-material conveyor belt in early 2024 reduces carbon emissions by 25%, while Bridgestone’s 2024 specialized belts for electric vehicle manufacturing highlight the shift toward low-energy, recyclable solutions in automotive assembly.

- Mining and Heavy Industry Dominance: Heavy-weight conveyor belts hold 85% of the market due to their durability in bulk material handling, with mining accounting for 30% of global demand. India’s coal production exceeding 200 million tons in 2022 spurred INR 123 billion in mining infrastructure investments, boosting conveyor adoption for efficient ore transport in rugged terrains.

- Advanced Safety and Monitoring Features: Enhanced systems with emergency stops, guardrails, and real-time sensors ensure compliance with evolving regulations, reducing accidents by 40%. Gartner’s forecast indicates 70% of large industrial firms will use digital twins for conveyor optimization by 2025, as demonstrated by Siemens and Honeywell’s 2024 monitoring platforms that detect vibrations and misalignments instantly.

Growth Factors in the Conveyor Belt Market

- Rising Industrial Automation and Mechanization: The push for Industry 4.0 integrates conveyor systems with robotics and AI, projected to grow the market at a 4.3% CAGR to USD 8.2 billion by 2034. Global manufacturing hubs in Asia-Pacific, including China’s “Made in China 2025” initiative, drive 56% of demand through automated assembly lines in electronics and automotive sectors.

- Expansion in Mining and Resource Extraction: Increasing global demand for minerals fuels conveyor use in overland transport, with the mining segment commanding 48.6% share in tracking devices alone. Coal and metal production surges, like the U.S. Appalachian region’s 200 million tons in 2022, necessitate durable belts, supported by USD 406 MTPA capacity expansions in India’s mining projects.

- E-Commerce and Warehouse Infrastructure Boom: Online retail growth requires efficient material handling, with warehouses adopting omnidirectional and modular belts for complex layouts. Emerging markets’ middle-class expansion to 687 million households by 2034 amplifies logistics needs, as evidenced by a 14.2% U.S. e-commerce rise in 2021 leading to USD 292.5 million in rubber conveyor investments.

- Technological Advancements in Belt Design: Innovations like heat-resistant (29% market share) and lightweight polymer belts (15% growth in 2024) enhance durability and energy efficiency, cutting operational costs by 20%. Developments such as Dunlop’s OptimaHeat Xtreme single-ply belt in May 2022 enable higher throughput in cement and steel industries, reducing maintenance shutdowns.

- Stringent Safety and Regulatory Compliance: Global standards like EU recycling mandates and U.S. mining safety codes propel investments in fire-resistant and self-cleaning belts, growing at 5.9% CAGR through 2030. North America’s 89% cold chain-like infrastructure focus, combined with USD 13 billion annual investments in efficient systems, ensures compliance while minimizing spoilage and hazards in food processing and logistics.

Leading Companies Operating in the Global Conveyor Belt Industry:

- Bando Chemical Industries, Ltd.

- Fenner

- Intralox

- Volta Belting Technology Ltd.

- Fives

- Continental AG

- Bridgestone Corporation

- Yokohama Rubber Company

- Habasit AG

- Ammeraal Beltech

Conveyor Belt Market Report Segmentation:

Breakup By Type:

- Medium-Weight Conveyor Belt

- Light-Weight Conveyor Belt

- Heavy-Weight Conveyor Belt

Medium-weight conveyor belt accounts for the majority of shares (56.9%) on account of its versatility and widespread adoption across various industries for handling moderately weighted materials efficiently.

Breakup By End-Use:

- Mining and Metallurgy

- Manufacturing

- Chemicals

- Oils and Gases

- Aviation

- Others

Mining and Metallurgy dominates the market (40.9%) due to the heavy reliance on conveyor belts for transporting raw materials, minerals, and ores in harsh operational environments with continuous material flow requirements.

Breakup By Region:

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- North America (United States, Canada)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Asia Pacific enjoys the leading position (37.1%) owing to rapid industrialization, expanding manufacturing sectors, booming e-commerce growth, and extensive infrastructure development projects across emerging economies in the region.

Recent News and Developments in Conveyor Belt Market

- November 2024: Masaba introduced a new series of self-contained hydraulic radial stacking conveyors designed for remote job sites, capable of handling 500 tons per hour with 80 or 100-foot length options, enhancing material handling efficiency in mining and construction operations.

- May 2024: Montech launched a new belt conveyor line certified for ISO air purity classes 4, 5, and 6, specifically tailored for cleanroom applications in pharmaceutical and semiconductor industries to prevent contamination and support high-precision manufacturing processes.

- June 2024: Forbo Movement Systems unveiled the Transilon E 2/1 U0/U8 LG blue FDA conveyor belt, optimized for narrow knife-edge applications in tubular bag packaging machines, ideal for conveying unpackaged food products like chocolate bars and snacks with FDA-compliant hygiene standards.

- April 2024: Continental AG debuted the Conti+ 2.0 Monitoring system at MINExpo 2024, featuring wireless edge devices that transmit real-time splice-strain and idler-vibration data for predictive analytics, reducing downtime in heavy-duty mining conveyor operations.

- March 2025: Compañía Minera Antamina in Peru received approval for a USD 2 billion mine life-extension project through 2036, including major upgrades to overland conveyor systems to boost copper and zinc output while integrating energy-efficient belt technologies for sustainable expansion.

- February 2024: Fenner Dunlop partnered with International Conveyor and Rubber (ICR) to enhance conveyor belt services for underground coal mining, combining premium polymer belts with specialized installation and maintenance expertise to improve safety and operational reliability in challenging environments.

- April 2024: Continental AG launched a new line of IoT-enabled conveyor belts equipped with embedded sensors for real-time monitoring and predictive maintenance, targeting North American logistics and manufacturing sectors to minimize unplanned downtime by up to 30% through data-driven insights.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302