Market Overview:

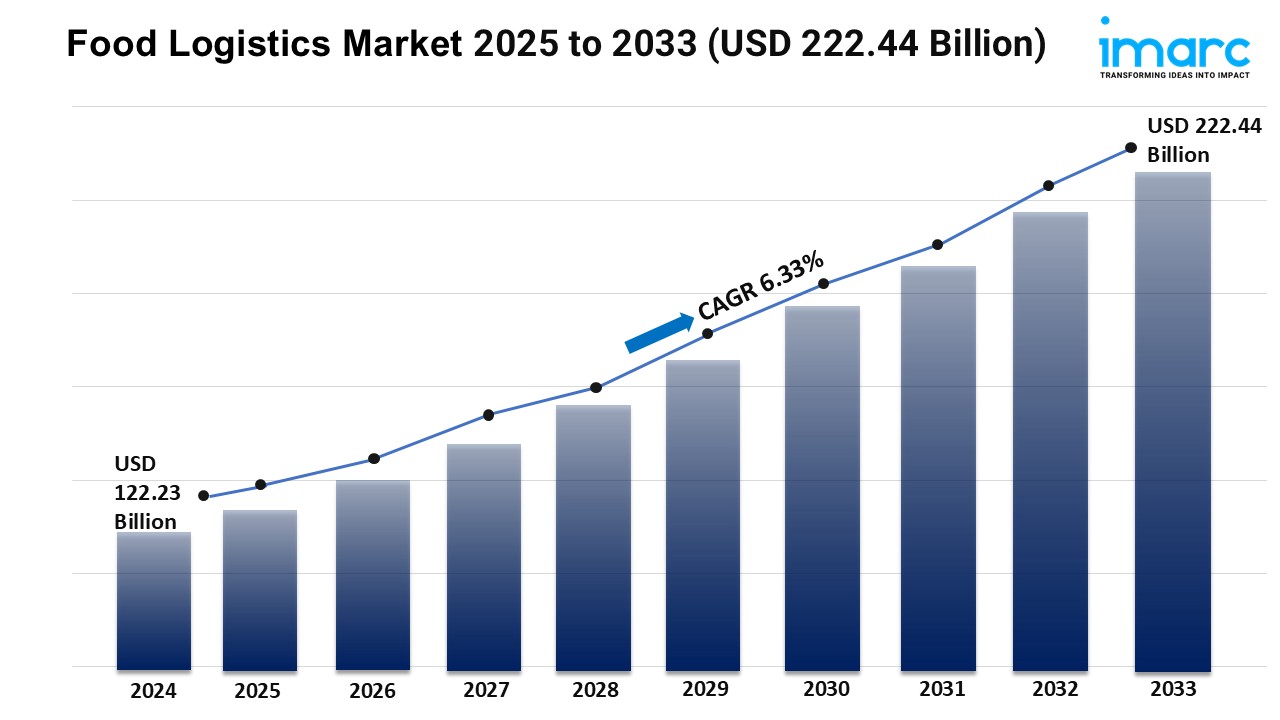

According to IMARC Group’s latest research publication, “Food Logistics Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033“, The global food logistics market size reached USD 122.23 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 222.44 Billion by 2033, exhibiting a growth rate (CAGR) of 6.33% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

How AI is Reshaping the Future of Food Logistics Market

- AI-powered predictive analytics forecast demand patterns with unprecedented accuracy, enabling logistics companies to optimize capacity allocations, reduce food waste by 20%, and improve delivery efficiency through machine learning algorithms analyzing weather, traffic, and historical data.

- Artificial intelligence automates warehouse operations through robotics and neural networks for picking and packing, increasing productivity in repetitive tasks while freeing operators for complex activities, reducing handling time and maximizing space utilization with intelligent product organization algorithms.

- AI-driven route optimization determines the most efficient transportation paths by analyzing real-time traffic conditions, reducing fuel costs by up to 26%, and ensuring refrigerated and frozen products arrive in perfect condition while minimizing carbon emissions and delivery times.

- Machine learning enhances cold chain integrity through IoT-enabled temperature monitoring systems that detect deviations immediately, triggering automated corrective actions before spoilage occurs, reducing equipment failure risks by 30% and maintaining product quality throughout the supply chain.

- AI-based predictive maintenance transitions logistics operations from reactive to proactive strategies, analyzing sensor data to anticipate equipment failures before they occur, prolonging machinery operational life by 20-30% and preventing costly disruptions in temperature-controlled environments.

Download a sample PDF of this report: https://www.imarcgroup.com/food-logistics-market/requestsample

Key Trends in the Food Logistics Market

- Cold Chain Technology Revolution: Advanced temperature-controlled logistics dominate with 61.2% market share, driven by rising demand for fresh, frozen, and organic foods. Raben Group’s EUR 10 million investment in zero-emission logistics centers with TCL cooling chambers in Thessaloniki exemplifies the shift toward sustainable refrigeration technologies.

- E-Commerce and Last-Mile Delivery Surge: Fourth-quarter 2024 U.S. retail e-commerce sales reached USD 308.9 billion, up 9.4% year-over-year, with e-commerce accounting for 16.4% of total sales. Online grocery shopping and food delivery services drive investments in efficient last-mile solutions and automated warehousing systems.

- Real-Time Tracking and Blockchain Integration: GPS tracking, RFID technology, and blockchain enhance supply chain transparency and traceability. Companies implement IoT-enabled smart sensors providing continuous temperature monitoring from production facilities to retail shelves, enabling immediate corrective actions and reducing spoilage exceeding 20%.

- Sustainability and Green Logistics Focus: Companies adopt electric refrigerated trucks, solar-powered cold storage, and eco-friendly packaging to reduce carbon footprints. North America leads with 89.20% cold chain infrastructure share, with logistics providers prioritizing energy-efficient warehouses and low-emission transport solutions.

- Automation and Warehouse Management Systems: Large-scale warehouses between 200,000 and 499,999 square feet require automation for efficiency. Transportation Management Systems (TMS) and Warehouse Management Systems (WMS) integrate logistics operations, improving cost-effectiveness through AI-driven inventory management and automated sorting processes.

Growth Factors in the Food Logistics Market

- Rising Demand for Perishable Foods: Consumer preference for fresh, frozen, and processed foods necessitates efficient cold chain solutions. World Bank reports investing USD 13 billion annually in nutrition programs could prevent 6.2 million child deaths, with two out of three U.S. consumers demanding fresh food driving logistics infrastructure expansion.

- Globalization of Food Trade: FAO reports food trade comprises 85% of all agriculture trade in 2022. Cross-border food movement requires sophisticated multi-modal transportation solutions, specialized logistics services, and compliance with international health and safety regulations, driving investment in integrated supply chain management systems.

- Technological Advancements in Logistics: Integration of GPS tracking, RFID technology, IoT-enabled monitoring, and AI-powered predictive analytics revolutionize food transportation. Temperature-controlled logistics with sophisticated refrigeration and climate-control systems maintain perishable goods quality, reducing waste and improving operational efficiency throughout supply chains.

- E-Commerce Platform Expansion: Rising middle-class populations in emerging markets expected to double from 354 million to 687 million households by 2034 fuel logistics infrastructure development. Online grocery sales and meal kit services increase demand for reliable cold chain networks ensuring timely and fresh deliveries.

- Stringent Food Safety Regulations: Government regulations like the U.S. Food Safety Modernization Act (FSMA) emphasize high-quality food transportation and storage. EU agri-food exports reached EUR 21.7 billion in October 2024, reflecting 10% monthly growth, driving investments in compliance systems and temperature-controlled logistics.

Leading Companies Operating in the Global Food Logistics Industry:

- AmeriCold Logistics LLC

- DSV

- C.H. Robinson Worldwide, Inc.

- Schneider National

- CaseStack

- A.N. Deringer, Inc.

- Echo Global Logistics, Inc.

- Evans Distribution Systems, Inc.

- Hellmann Worldwide Logistics SE & Co. KG

- Matson Logistics

- Odyssey Logistics & Technology Corporation

Food Logistics Market Report Segmentation:

Breakup By Transportation Mode:

- Railways

- Roadways

- Seaways

- Airways

Roadways dominates the market with 52.8% share due to flexibility, cost-effectiveness, extensive reach, efficient last-mile delivery capabilities, and better accessibility to remote areas, enhanced by GPS tracking, route optimization, and IoT-enabled temperature monitoring technologies.

Breakup By Product Type:

- Fish, Shellfish, and Meat

- Vegetables, Fruits, and Nuts

- Cereals, Bakery and Dairy Products

- Coffee, Tea, and Vegetable Oil

- Others

Fish, Shellfish, and Meat accounts for significant market share driven by rising global protein consumption, health consciousness, dietary preferences, strict food safety regulations requiring temperature-controlled storage and transportation, and expanding cross-border trade of seafood and meat products.

Breakup By Service Type:

- Cold Chain

- Non-Cold Chain

Cold Chain represents the majority with 61.2% market share due to rising demand for temperature-sensitive products including dairy, seafood, frozen foods, and fresh produce, requiring advanced temperature-controlled storage and transportation solutions with IoT-enabled tracking and automated cooling technologies.

Breakup By Segment:

- Transportation

- Packaging

- Instrumentation

Transportation leads the market as the critical segment ensuring timely and efficient food distribution. Rising demand for perishable products necessitates reliable transportation solutions maintaining quality and safety through advanced cold chain logistics, refrigerated trucks, temperature-controlled containers, and multimodal networks.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America enjoys the leading position with 43.2% market share owing to advanced infrastructure, strong cold chain networks, well-developed transportation systems, high demand for perishable foods, rising e-commerce penetration, stringent food safety regulations, and technological advancements in tracking and automation.

Recent News and Developments in Food Logistics Market

- October 2024: Walmart announced a USD 500 million investment in a robotic distribution center in Silao, Guanajuato, Mexico. This advanced facility serves 600+ stores across eight states and incorporates AI-powered automation from Symbotic, making it one of Latin America’s most technologically advanced logistics centers.

- July 2024: Raben Group announced a EUR 10 million investment in a zero-emission logistics center in Thessaloniki, Greece. Built on 50 acres with 4,000m² warehouse, 40 ramps, and TCL cooling chambers for food products, scheduled for completion in 2025.

- May 2024: Uber Eats and Instacart partnered to enhance food delivery services in the United States, strengthening last-mile delivery capabilities and expanding market reach for temperature-sensitive food products through improved logistics networks and collaborative distribution strategies.

- January 2025: Logwin Group acquired Hanse Service Internationale Fachspedition GmbH and Pharmalogisticspartner in Hamburg, strengthening pharmaceutical and food logistics expertise with certified temperature-controlled logistics including 7,600m² storage, enhancing national and international cold chain capabilities.

- 2024: C.H. Robinson Worldwide, Inc. rolled out an advanced tracking system integrating cloud technology to monitor sensitive food shipments, providing end-to-end visibility across the supply chain with real-time temperature monitoring and automated alerts for deviation management.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302