UAE Household Appliances Market Overview

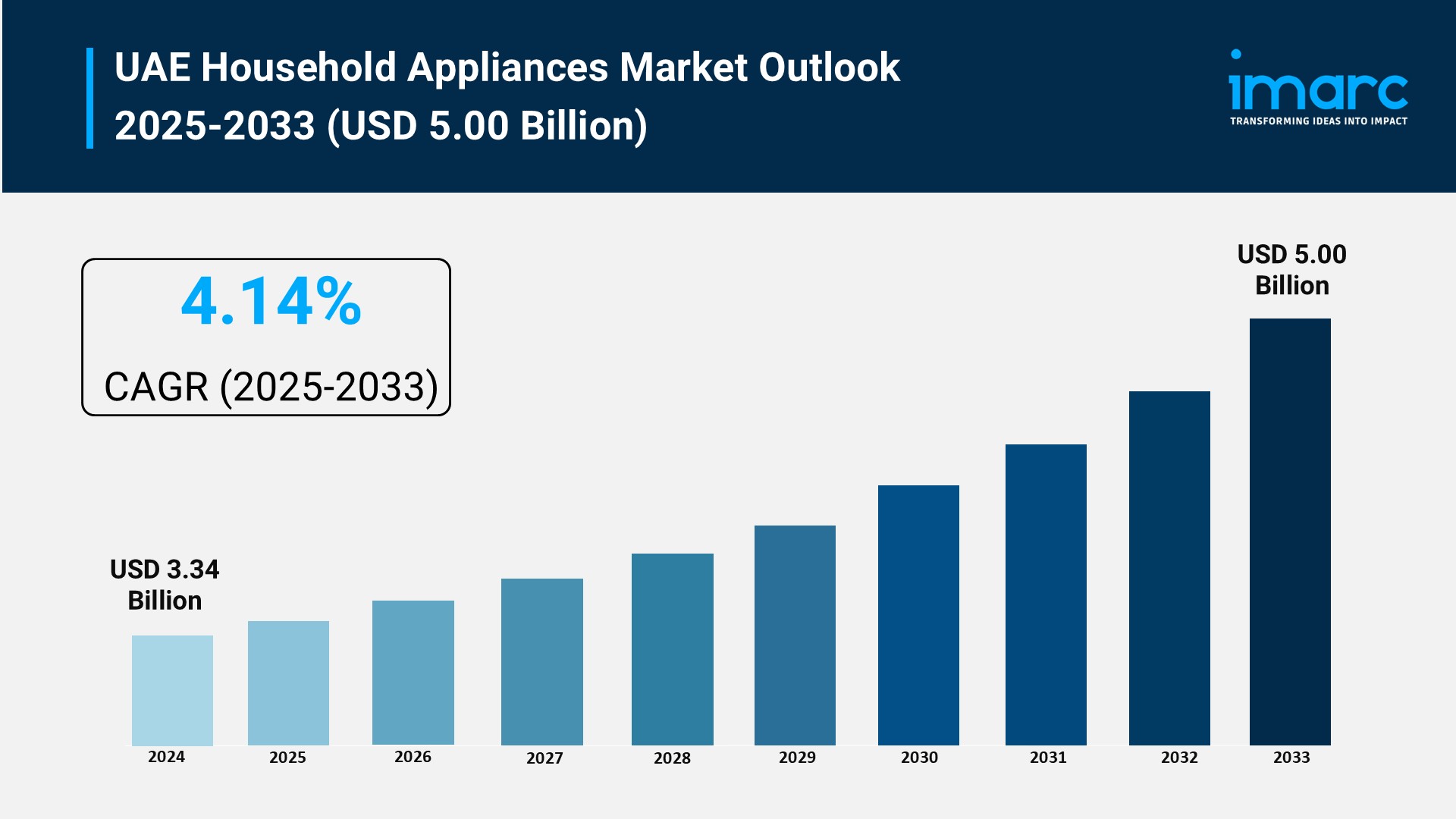

Market Size in 2024: USD 3.34 Billion

Market Size in 2033: USD 5.00 Billion

Market Growth Rate 2025-2033: 4.14%

According to IMARC Group’s latest research publication, “UAE Household Appliances Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033”, The UAE household appliances market size was valued at USD 3.34 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 5.00 Billion by 2033, exhibiting a growth rate of 4.14% during 2025-2033.

How AI is Reshaping the Future of UAE Household Appliances Market

- Powering Smart Homes at Scale: With over 2.85 million registered users on Samsung’s SmartThings platform across the region, AI-enabled appliances are transforming UAE homes with voice control in Arabic, English, and Urdu, reflecting the country’s multicultural environment while learning user habits for automatic temperature, lighting, and energy management.

- Driving Energy Efficiency Goals: AI-powered appliances are helping UAE residents tackle extreme desert heat efficiently, with smart cooling systems cutting energy consumption by 20-30% while the government’s Energy Strategy targets 42-45% improvement in energy efficiency, making intelligent appliances essential for achieving sustainability targets.

- Revolutionizing Kitchen Experiences: Hisense’s ConnectLife platform with Microsoft Azure AI Studio launched Dish Designer, an AI recipe assistant that suggests personalized recipes based on available ingredients and dietary needs, while LG’s AI sensors detect fabric types and load sizes to optimize wash cycles, saving water and energy.

- Accelerating E-Commerce Transformation: Online platforms are leveraging AI for augmented reality product visualization and same-day delivery, with e-commerce channels projected to grow faster than traditional retail as platforms like Amazon.ae and Noon.com enhance shopping experiences through smart recommendations and flexible Buy-Now-Pay-Later options.

- Supporting Government Smart City Initiatives: As Dubai aims to become the world’s smartest city, with 100% internet penetration and over 18 million active mobile subscriptions, AI-enhanced appliances integrate seamlessly with 5G networks and IoT ecosystems, supporting national visions like UAE 2021 and Dubai Clean Energy Strategy 2050.

Grab a sample PDF of this report: https://www.imarcgroup.com/uae-household-appliances-market/requestsample

How Energy Strategy 2050 is Revolutionizing UAE Household Appliances Industry

The UAE Energy Strategy 2050 is redefining the household appliances industry by targeting a 50% clean energy mix and 40% efficiency gains, compelling manufacturers to innovate low-emission, high-performance products that curb residential power demands. This framework accelerates adoption of energy-star rated refrigerators, inverters in air conditioners, and smart washers that integrate solar compatibility, slashing utility costs in heat-prone villas and apartments. Megaprojects like Dubai’s Sustainable City amplify this shift, where incentives for IoT-enabled appliances reward households for reduced consumption via rebates and smart grid linkages.

Public-private collaborations with firms like Samsung spur R&D for AI-optimized cooling systems, aligning with net-zero ambitions by minimizing fossil fuel reliance in daily chores. As expatriate families swell, the strategy fosters resilient supply chains for eco-materials, curbing imports and creating jobs in green assembly lines. This pivot not only fortifies energy security against volatility but elevates appliances from utilities to sustainability enablers, blending luxury with low-carbon living to cement UAE’s global leadership in efficient home tech.

UAE Household Appliances Market Trends & Drivers:

The UAE household appliances market buzzes with trends toward smart integrations and compact designs, as urban millennials and expats favor IoT-connected refrigerators and air purifiers for seamless living in high-rises. E-commerce surges via Amazon.ae, blending AR previews with quick deliveries, while premium segments like steam ovens thrive on fusion cuisines in diverse kitchens. Sustainability steers choices to inverter tech and recyclable materials, countering desert heat with energy-sipping models, as small appliances like robot vacuums gain from busy lifestyles in Dubai’s free zones.

Rising disposable incomes and Expo legacies propel growth, channeling funds into housing booms that demand durable, feature-rich units for nuclear families. Government pushes under Energy Strategy 2050 incentivize efficient imports, offsetting raw material swings through localization perks. This mix of tech savvy, policy support, and demographic influxes builds a resilient ecosystem, turning appliances into smart home cornerstones that enhance comfort and cut footprints across residential and hospitality spheres.

UAE Household Appliances Industry Segmentation:

The report has segmented the market into the following categories:

Product Insights:

- Refrigerator

- Air Conditioner and Heater

- Entertainment and Information Appliances

- Washing Machine

- Dish Washer

- Wall Oven

- Microwave

- Cooking Appliances

- Coffee Machine

- Blender

- Juicer

- Canister

- Deep Cleaners

- Steam Mop

- Others

Distribution Channel Insights:

- Supermarket and Hypermarket

- Specialty Store

- E-Commerce

- Others

Regional Insights:

- Dubai

- Abu Dhabi

- Sharjah

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Recent News and Developments in UAE Household Appliances Market

- February 2024: Eros, the UAE’s largest electronics retailer, launched its in-house home appliance brand “Krome” targeting the mid-tier price segment with refrigerators, air-conditioners, gas stoves, and water dispensers priced 20-30% lower than global brands. The move leverages Eros Group’s 56 years of market expertise and established retail network across 15 stores to offer economical luxury with products assembled from manufacturing plants in India, China, and Turkey.

- December 2024: Hisense showcased its latest smart home innovations at CES 2025, featuring kitchen, living room, laundry, and home office appliances integrated through the ConnectLife platform. The company’s Dish Designer, developed with Microsoft Azure AI Studio, offers AI-powered recipe assistance based on available ingredients and dietary preferences, while the Jumbo Side-by-Side Refrigerator became the market’s largest and most volumetrically efficient smart refrigerator with integrated screens and IoT connectivity.

- July 2025: Samsung Electronics launched its 2025 Bespoke AI lineup in the Middle East, debuting the Bespoke AI Laundry Combo with 25kg wash and 18kg dry capacity. The new range features AI-integrated screens with built-in diagnostics, AI sensors that detect fabric types for optimized wash cycles, and seamless integration with the SmartThings Home ecosystem, advancing the company’s vision of AI-driven home experiences across the region.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302